India’s Pellet Production Rises Over 10% Year-On-Year in Apr-Sep 2024: Will the Growth Trend Continue?

India's pellet production has seen impressive growth, recording over a 10% year-on-year increase from April to September 2024. This notable rise reflects the country’s increased focus on sustainable iron ore utilization, demand growth in key sectors, and significant policy support. This blog delves into the factors behind the surge in pellet production and analyzes if this growth trend is sustainable in the coming years.

What Are Iron Ore Pellets, and Why Are They Important?

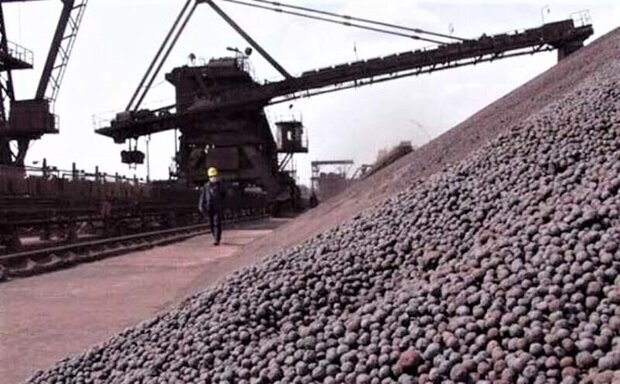

Iron ore pellets are small, ball-shaped pellets made from iron ore fines. They play a crucial role in the steel industry as an alternative to traditional iron ore and have several advantages, including:

- High efficiency in steel manufacturing

- Reduced energy consumption due to better feedstock quality

- Environmental benefits, as they minimize emissions in steel production

With India's steel demand rising, the role of pellets as a raw material has gained importance, leading to a robust market demand for pellets in India.

Factors Driving India’s Pellet Production Growth in Apr-Sep 2024

1. Increased Domestic Demand for Steel

India’s steel demand has grown considerably due to massive infrastructure projects, expanding construction, and automotive industries. The production of steel, particularly through Electric Arc Furnaces (EAF) and Direct Reduced Iron (DRI) methods, benefits from iron ore pellets, as they contribute to efficient and high-quality steel production.

2. Export Opportunities

The global demand for iron ore pellets, especially from Europe and East Asia, remains strong. Several international markets are adopting environmentally friendly production methods, which emphasize the use of high-grade pellets. Indian pellet producers have tapped into these opportunities, driving exports and increasing their production to meet global demand.

3. Government Initiatives and Policy Support

Indian policies promoting self-reliance in steel production and an emphasis on “Make in India” have stimulated growth in various raw materials, including pellets. For instance:

- The National Steel Policy 2017 aims to make India a hub for high-grade steel production.

- Tariff adjustments and export incentives make pellet exports more attractive to producers.

This support has fueled the pellet manufacturing sector, aligning with India's ambition to become a global steel powerhouse.

4. Technological Advancements in Pellet Manufacturing

Advancements in pelletization technology have enhanced production capabilities, enabling manufacturers to produce higher-grade pellets with lower emissions and optimized energy use. Technologies like grate-kiln and straight-grate systems have reduced production costs and improved pellet quality, making it feasible for companies to expand their production capacities.

5. Increased Investment in Pellet Production Plants

Both government and private investments in setting up new pellet plants or expanding existing ones have significantly added to production capacity. Key players in India’s pellet production landscape, including Tata Steel and JSW Steel, have strategically invested in expanding their pelletizing plants to keep up with rising demand.

Challenges That Could Impact Pellet Production Growth

1. Supply Chain Bottlenecks

Disruptions in raw material supply, especially iron ore, could impact pellet production. Factors like mining restrictions, logistical challenges, and transportation costs can influence the availability of iron ore fines, impacting pellet production and exports.

2. Environmental Regulations and Compliance

Stringent environmental norms could lead to higher compliance costs for pellet manufacturers. Increasing pressure to reduce emissions and improve waste management may require investments in sustainable technologies. Although these changes are beneficial long-term, they could affect profit margins if companies cannot offset these costs.

3. Global Competition and Pricing Pressures

Indian pellet manufacturers face competition from Brazil, Australia, and other iron ore-rich nations. These countries have long-established export channels, and competition on pricing may impact India’s market share, especially in price-sensitive regions.

4. Unstable Export Markets

While global demand for pellets is currently strong, fluctuations in international markets due to geopolitical tensions, economic downturns, or policy changes in importing countries could create uncertainty. For instance, any economic slowdown in China, a major iron ore consumer, could have ripple effects on Indian pellet exports.

Will India’s Pellet Production Continue to Grow?

Given the current drivers and market dynamics, India’s pellet production is poised to sustain its growth, but certain conditions will influence the future trajectory:

- Focus on Domestic Infrastructure Development

- Rising Global Focus on Low-Emission Steel Production

- Expansion of Pellet Production Facilities

- Supportive Government Policies and Incentives

- Economic Growth and Rising Consumption

Conclusion: A Positive Outlook for Pellet Production Growth

India’s over 10% increase in pellet production from April to September 2024 showcases the country’s strategic efforts to support the growing steel industry and capitalize on export potential. While certain challenges, such as supply chain disruptions and environmental regulations, may create headwinds, the overall trend remains positive.

With supportive policies, rising demand, and advancements in pellet technology, the growth trajectory for India’s pellet production appears promising. By addressing potential challenges and investing in future-ready technologies, India can continue its upward trend and become a leader in sustainable pellet production on the global stage.