OMC Slashes Iron Ore Lump Prices: All You Need to Know About the Upcoming E-Auction

The Odisha Mining Corporation (OMC) has made a pivotal move in the iron ore market by slashing the base prices for lumps ahead of its 173rd iron ore e-auction, scheduled for November 20, 2024. The auction will offer approximately 2 million tonnes (mnt) of iron ore, split into 0.87 mnt of lumps and 1.15 mnt of fines. This will be conducted through a transparent and competitive online platform.

OMC’s decision to reduce lump prices by INR 950 per tonne month-on-month (m-o-m) demonstrates its strategy to balance supply and demand amidst the current market dynamics. This blog delves into the auction details, pricing strategies, and the broader significance for the iron and steel industry.

Why Did OMC Cut Prices for Lumps?

OMC’s price cut follows a notable decline in sponge iron (C-DRI) prices, which have fallen by over INR 2,000 per tonne in the eastern region of India. As sponge iron is a key raw material for producing iron ore lumps, these price fluctuations directly impact demand.

By reducing lump prices, OMC is aiming to:

- Increase demand for lumps: The price reduction makes lumps more affordable for sponge iron producers, potentially boosting participation in the auction.

- Align with market conditions: By ensuring competitive pricing, OMC is reinforcing its leadership while catering to buyers' needs.

- Stabilize revenue streams: A price correction can stimulate higher sales volumes, crucial for maintaining revenue during market fluctuations.

Interestingly, while lump prices have been slashed, OMC has opted to keep the prices for iron ore fines stable, likely due to sustained demand for fines, primarily used in pellet production.

Market Recap: Iron Ore Price Trends and Market Dynamics

Recent data from BigMint's Iron Ore & Pellet Market Recap (11-16 Nov 2024) highlights several key market developments, which align with OMC’s pricing adjustments:

- Price Declines in Odisha: Iron ore lumps (Fe 60%) fell by 5% (₹6,350/t), and fines (Fe 62%) decreased by 2% (₹5,350/t).

- Pellet Price Pressure: Pellet prices dropped by 6% ($92.5/t), reflecting weak downstream demand in the steel sector.

- Steady Mill Scale Prices: Prices for mill scales in Raipur and Kandla saw slight increases of 3% and 1%, respectively, supported by export demand.

- Concentrate Price Growth: Concentrates from Madhya Pradesh (Fe 63%) rose by 3% to ₹5,050/t, indicating strong demand from secondary markets like cement production.

- Vessel Freight Trends: Freight rates for SupraMax vessels from Paradip to Qingdao increased by 2% ($12.50/t), signaling growing inquiries despite limited demand in the Indian Ocean.

These market movements provide important context for OMC’s decision to adjust lump prices while keeping fines prices stable, enhancing the appeal of the auction to buyers across various segments.

Auction Specifications: Grades, Locations, and Floor Prices

The upcoming auction will offer a wide range of iron ore grades from key mining locations in Odisha. Here's a detailed breakdown of the auction:

1. Iron Ore Lumps (62%-65% Fe)

- Grade Range: Iron content (Fe) varies between 62% and 65%.

- Lump Sizes: Sizes range from 10-40 mm and 5-18 mm depending on the lot.

Floor Prices:

- The lowest floor price is INR 5,100/tonne for lumps from Mahaparbat (62% Fe).

- The highest floor price is INR 6,600/tonne for lumps from the Barbil region, reflecting higher demand and ore quality.

2. Iron Ore Fines (Below 60% Fe)

- Sub-Grade Material: Fines with Fe content below 60% are being offered at a lower price point.

Floor Price: Fines start at INR 4,100/tonne for Mahaparbat.

3. Key Mining Locations:

- Daitari: Known for stable, high-grade ore.

- Gandhamardan Block-B: A key contributor to OMC’s production.

- Barbil Region (Guali and Jilling Mines): Premium-grade ore hub.

- Koira and Khandbandh: High-grade lumps and fines, essential for sponge iron and pellet-making.

These specifications ensure transparency, offering clarity for potential buyers regarding quantity, grade basis, and size tolerances.

E-Auction Trends: Sales Volume Insights

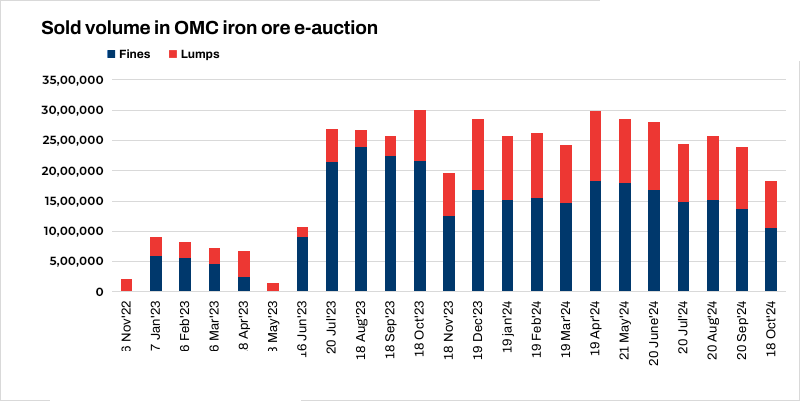

OMC’s auction data from past months provides valuable insights into market trends:

- Steady Growth: Auction sales peaked in July 2023 and March 2024, linked to increased steel production.

- Dominance of Fines: Iron ore fines consistently accounted for higher sales volumes compared to lumps, aligning with the rising demand for pellet production in the steel industry.

- Recent Stabilization: Sales volumes have recently stabilized, reflecting a balanced market between supply and demand.

These trends underscore the importance of market-responsive pricing, such as OMC’s adjustment for this auction.

Strategic Importance of OMC’s E-Auction

- Market Leadership: As one of India’s largest producers of iron ore, OMC’s transparent e-auction system strengthens its leadership in the industry.

- Boosting Sponge Iron Production: The price reduction is expected to benefit sponge iron producers, supporting India’s steel industry and improving competitiveness on both domestic and international levels.

- Supporting Secondary Industries: The inclusion of sub-grade fines caters to industries like cement manufacturing, ensuring accessibility for a broader range of buyers.

- Revenue Optimization: Price cuts may seem counterintuitive, but they can lead to increased sales volumes, thereby stabilizing OMC’s revenue stream.

Challenges and Opportunities

Challenges:

- Global Iron Ore Price Volatility: International market fluctuations can affect local demand and pricing.

- Environmental Regulations: Stricter mining regulations and sustainability goals may impact OMC’s operations.

Opportunities:

- Growing Steel Demand: Increasing demand for steel, driven by infrastructure growth, provides a robust market for iron ore.

- Expansion of Pelletization: The shift towards pelletization as an eco-friendly method for iron ore processing strengthens the demand for fines.

What to Expect from the Upcoming Auction

The 173rd e-auction on November 20, 2024, is set to attract significant attention due to several key factors:

- Attractive Pricing: The reduction in lump prices is particularly appealing to sponge iron producers.

- Diverse Offerings: A range of grades, sizes, and locations caters to both large steel manufacturers and secondary industries.

- Market Transparency: OMC’s e-auction platform ensures a fair, competitive process for all participants.

With a total offering of 8.67 lakh tonnes, this auction is a prime opportunity for buyers to secure high-quality iron ore at competitive prices.

Conclusion

OMC’s decision to reduce lump prices ahead of its upcoming auction underscores its commitment to adapting to market realities while addressing the needs of its buyers. This move is likely to stimulate demand, drive higher auction participation, and stabilize revenue streams—further solidifying OMC’s leadership in the iron ore industry. As the Indian iron and steel sectors evolve, OMC’s strategic pricing and transparent auction process set a benchmark for industry players. For buyers, the November 20 auction is an event not to be missed, offering a chance to secure high-grade ore at attractive prices.