Iron Ore and Pellet Market Recap: 13th – 18th January 2025

Overview of Market Trends

The iron ore and pellet market experienced notable dynamics during the week of 13th to 18th January 2025. Key segments such as fines, lumps, and pellets displayed varying price trends, reflecting shifts in demand and global market conditions. Domestic developments, auctions, and export dynamics were pivotal in shaping the price movements.

Highlights

- Odisha Iron Ore Fines Index: Fell week-on-week, reflecting limited buying amid muted demand in domestic markets.

- Pellet Export Index: Showed significant gains due to strong global demand and futures market activity.

- Freight Rates: Declined sharply on surplus vessel availability.

Detailed Analysis of Price Trends

Fines and Lumps

- Iron Ore Fines (Odisha Index, Fe-62%): Prices dropped by 4% to ₹5000/tonne. The decline was attributed to subdued buying after Odisha Mining Corporation’s (OMC) auction, which saw limited interest in fines lots.

- Iron Ore Fines (Odisha Index, Fe-60%): Marginal dip of 1% to ₹4500/tonne.

- Iron Ore Lumps (Odisha Index, Fe-60%): A 2% rise to ₹6400/tonne, indicating a preference for higher-grade materials.

- Iron Ore Fines (Karnataka, Fe-62%): Prices remained steady at ₹4950/tonne as market participants awaited clarity on regulatory changes, such as the Karnataka Mineral Rights and Mineral Bearing Land Tax Bill 2024.

- Export Fines: The export index surged by $6/tonne week-on-week, driven by increased global demand and expectations for February shipments.

Pellets

- Pellet Export Index: Climbed $9/tonne, underpinned by strong demand from global markets. The increase in pellet prices aligns with higher iron ore fines spot prices and futures indices.

- Domestic Pellets: Prices showed mixed trends:

- Exw Bellary (Fe-63%): Minor rise of 0.5% to ₹10800/tonne.

- DAP Kandla (Fe-63%): Increased by 3% to ₹11300/tonne.

- PELLEX: Fell by ₹50/tonne week-on-week, reflecting weak trading activity amid falling sponge iron prices.

Concentrates and Mill Scale

- Concentrates (Exw Jabalpur): Dropped 1% to ₹4600/tonne, reflecting weak sentiment in semi-finished steel markets.

- Mill Scale: Prices inched up by 1% to ₹6800/tonne (Exw Raipur).

Vessel Freight

Freight rates for Supramax vessels from Paradip to Qingdao, China, declined by 20% to $8.6/tonne, influenced by surplus vessel availability and a dip in the Baltic Index.

Global and Domestic Influences

Domestic Auctions and Regulatory Developments

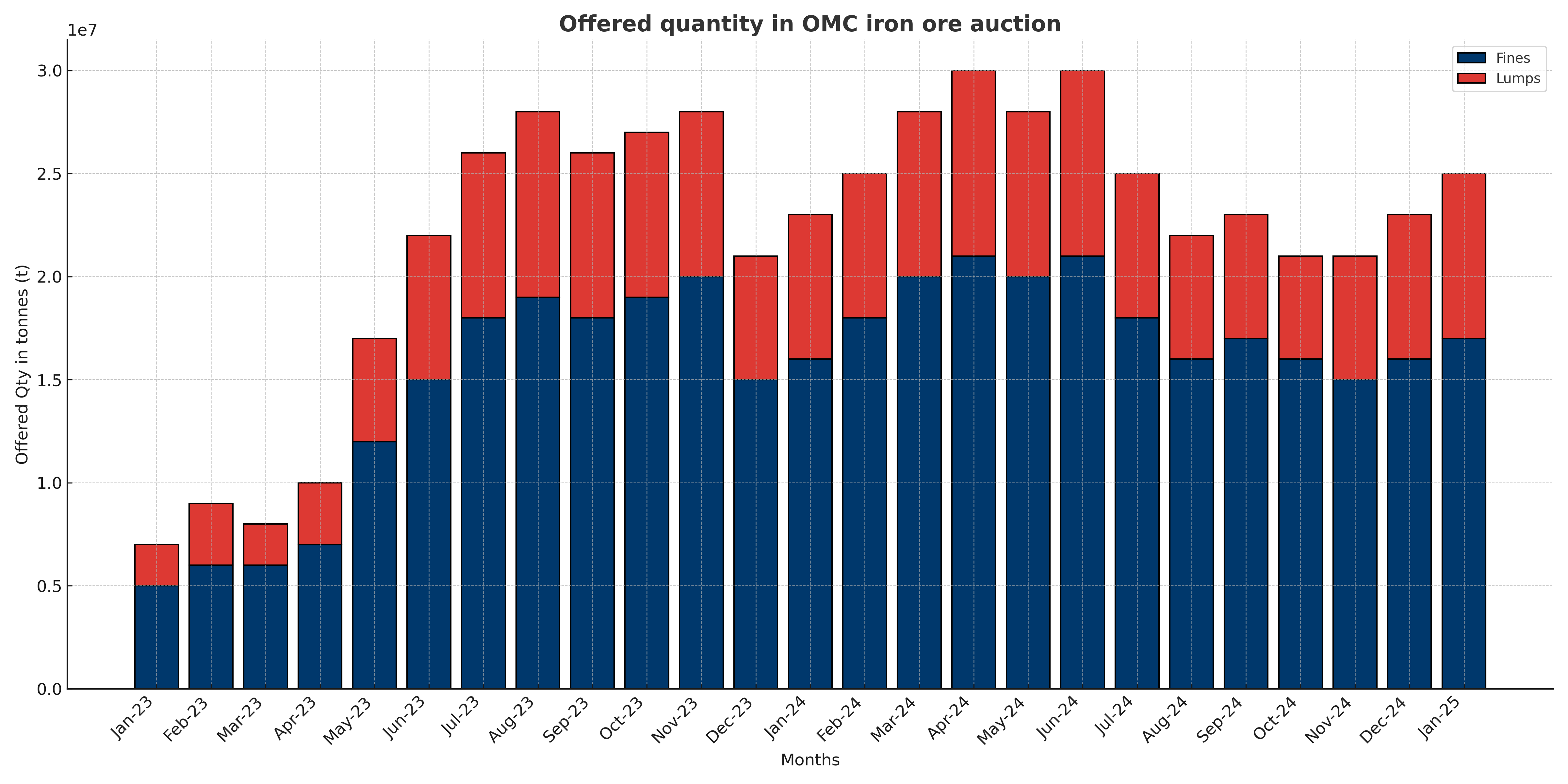

- OMC Auction: India’s second-largest merchant miner conducted an auction for 2.67 million tonnes of fines and lumps. However, only 7% of the offered quantity was booked, leading to reduced price support.

- Karnataka Market Sentiments: Regulatory uncertainties surrounding the Karnataka Mineral Rights and Mineral Bearing Land Tax Bill 2024 impacted trading activity, keeping prices steady.

Export Dynamics

Strong demand for February shipments drove India’s iron ore fines export index upward. Deals were concluded at a 17.5%-19% discount on the global index, boosting exporter optimism.

Pellet Exports

Increased global interest and futures market activity significantly boosted pellet export prices. India’s ability to cater to Southeast Asian and Middle Eastern markets reinforced its position as a key global supplier.

Key Challenges and Opportunities

Challenges

- Weak Domestic Demand: Limited interest in fines during domestic auctions has exerted downward pressure on prices.

- Freight Volatility: Declining freight rates may affect export profitability in the short term.

- Regulatory Uncertainty: Policy clarity in Karnataka is essential for sustaining market stability.

Opportunities

- Export Growth: Rising global demand for February shipments presents opportunities for exporters to capitalize on higher prices.

- Pellet Market Resilience: The sharp increase in the pellet export index highlights robust international demand, particularly in regions with constrained local production.

Future Outlook

Iron Ore Prices

Prices are expected to stabilize in the coming weeks as market participants digest the outcomes of recent auctions and regulatory updates. Export demand is likely to remain a key driver of price movements.

Pellet Market

Strong global demand, coupled with India’s competitive pricing, will continue to support pellet exports. Domestic prices may see moderate gains if sponge iron prices recover.

Freight Trends

Freight rates are expected to remain under pressure due to surplus vessel availability. However, a rebound in the Baltic Index could provide some support.

Conclusion

The iron ore and pellet market exhibited mixed trends during the week of 13th to 18th January 2025. While domestic demand remained subdued, export markets provided much-needed support. Regulatory clarity and global market dynamics will play crucial roles in shaping the future of the industry. Exporters are well-positioned to leverage rising global demand, particularly for pellets, while domestic markets await improved sentiment and policy stability.